The Shelby County Commission meets Wednesday to take another stab at approving a balanced budget.

The economic downturn makes that task more difficult.

We’re rolling into Fiscal Year 2021 with little room for error. The county will collect less than originally expected this year and has lowered its projections for the next.

Some are calling for us to make up the revenue shortfall by increasing property tax rates. Here are a few reasons why that can’t happen.

Property Tax Rate

Property taxes make up more than 60% of the county’s revenues. Think of property tax collections as the county’s income.

Because property taxes are more stable than sales taxes and other revenue streams, county government should be able to manage the immediate economic storm.

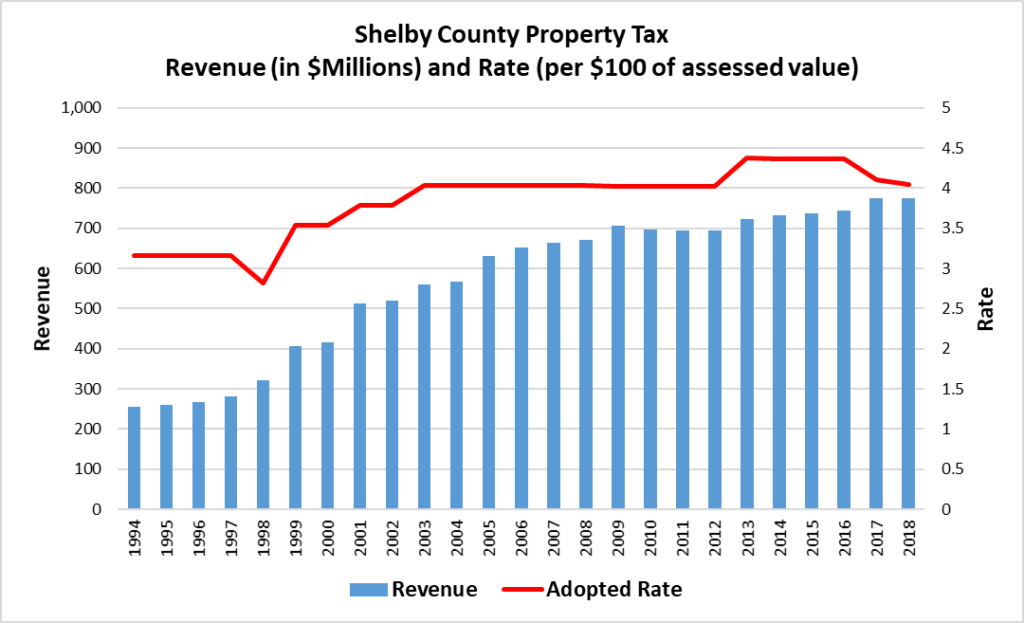

Property tax revenues have been rising every year, with or without rate increases, as this first chart illustrates.

Yes, property tax revenues could decline if economic conditions stagnate. But raising the rate is not a practical option when more residents are out of work and have bills piling up.

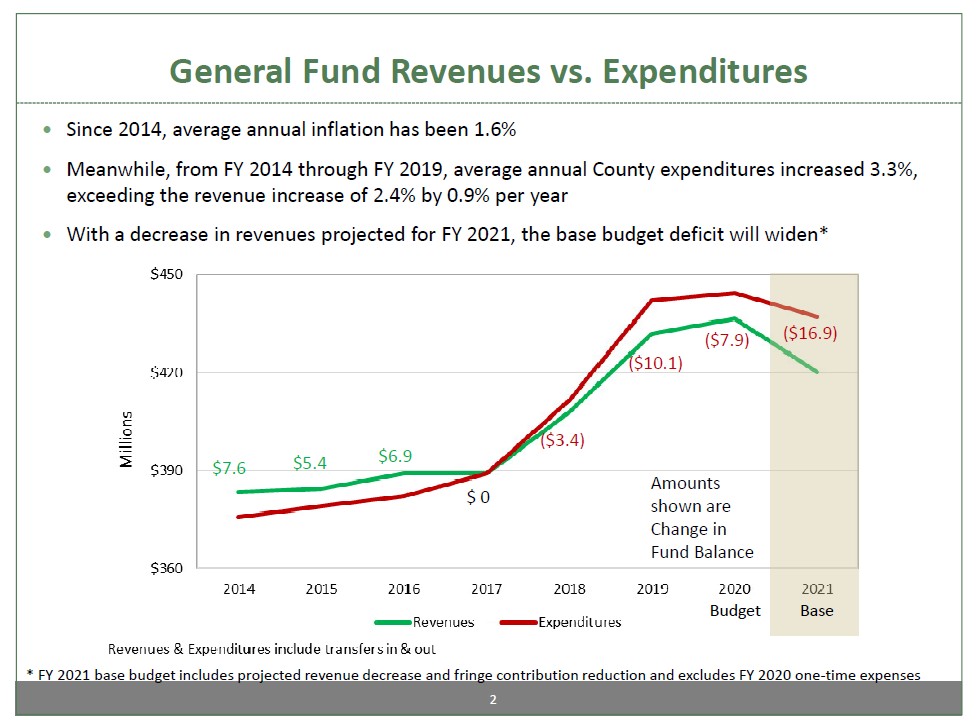

The county has been running a budget deficit for the past few years. The next chart shows why. It isn’t because of lower revenues.

Tax collections have continued to increase. The problem is the rate of spending has exceeded growth in revenues.

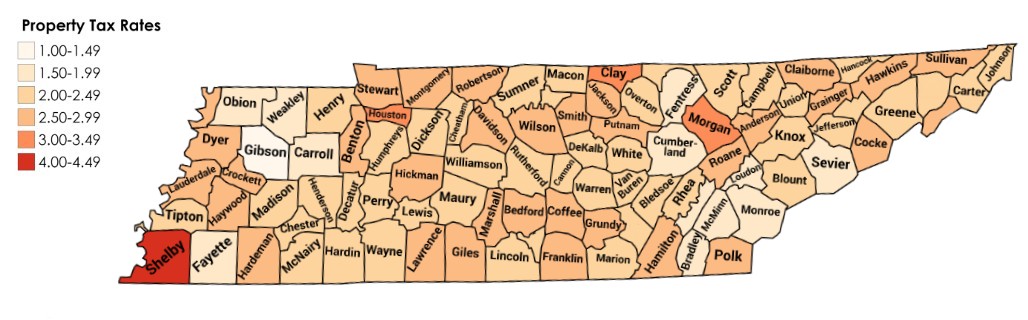

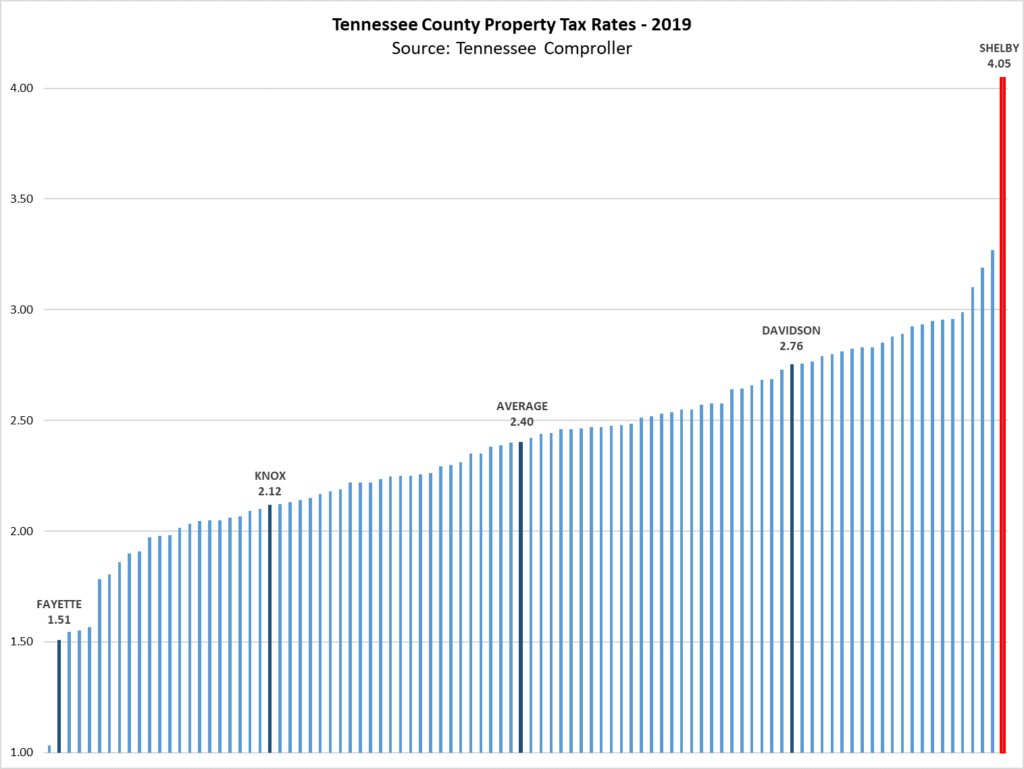

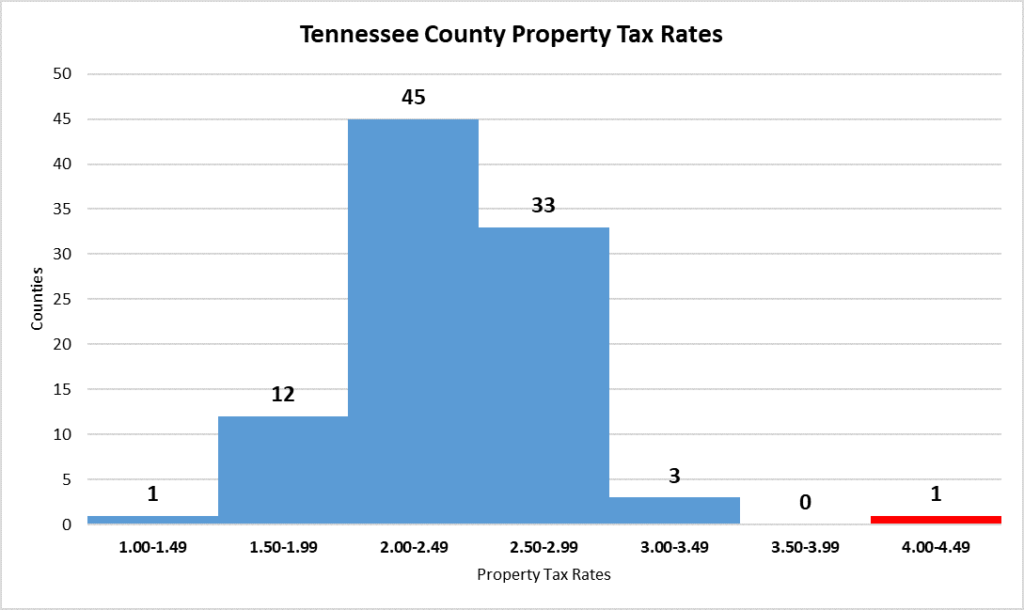

Another reason why the property tax rate shouldn’t increase is because Shelby County residents already pay the highest rate in the State of Tennessee.

Shelby County’s rate of 4.05 per $100 of assessed value is much higher than the second highest rate. And our next door neighbor, Fayette County, has the state’s second-lowest rate (see map at the top of this page for context).

No other county has a property tax rate even close to ours. Here’s another way of looking at how we match up with the rest of the state.

Shelby County taxpayers are paying more than enough. Our government needs to find a way to work with what it already takes in.

Unfortunately, Shelby County seems to have a hard time doing that. It continues to raid the general fund balance to make ends meet.

General Fund Balance

If property tax collections are the county’s income, the general fund balance is its savings account.

That savings account was built up over a few years but is now dwindling because Shelby County is spending more than it takes in.

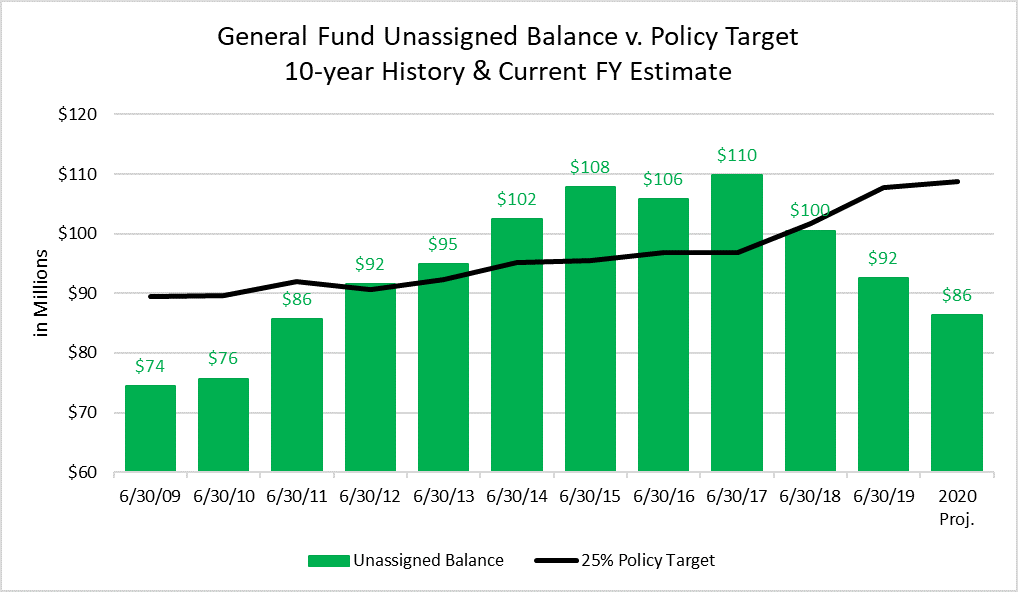

Shelby County has a policy that it will keep 25% of its revenue in the general fund balance. This next chart shows how well the county has done in meeting that policy goal.

As you can see, the county is expected to fall well short of the target this year, and it also came up short in the previous two years.

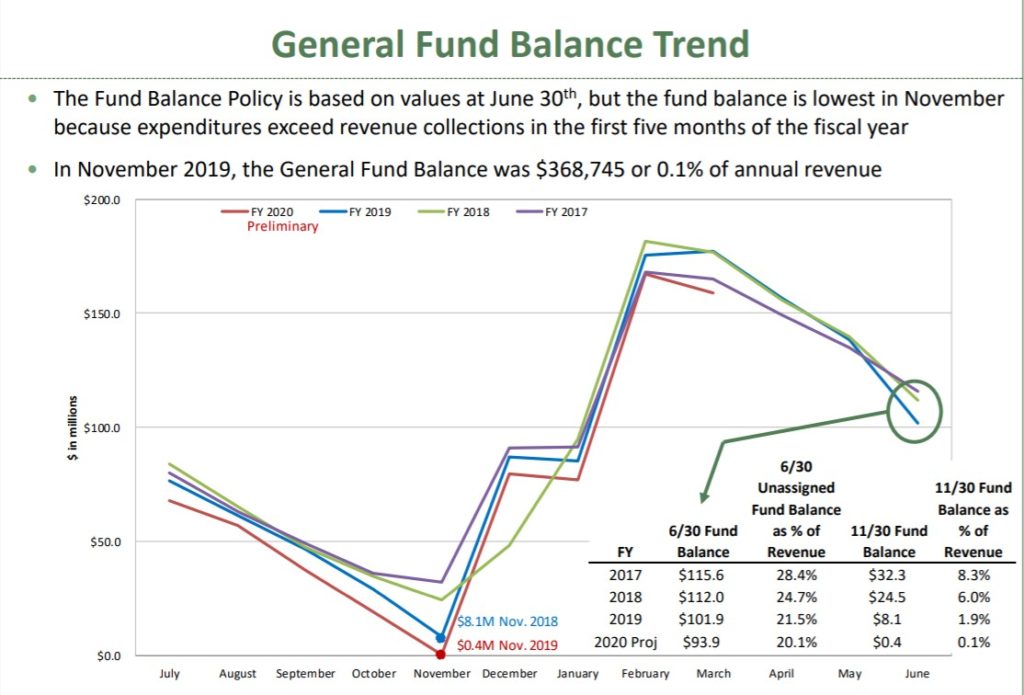

Why is that important? This is important because the fund balance is not a static number. It is an account that fluctuates throughout the year and is used to pay county employees and maintain government operations.

The bulk of the county’s revenue comes in at one time of year, when the fund balance hits its highest point. Then it falls for the remainder of the year, as the chart below reveals.

If the fund balance goes any lower, there will be a negative balance in autumn, which means the county will be temporarily unable to pay its bills.

That’s a real problem. And that’s why we need to be more careful with the fund balance.

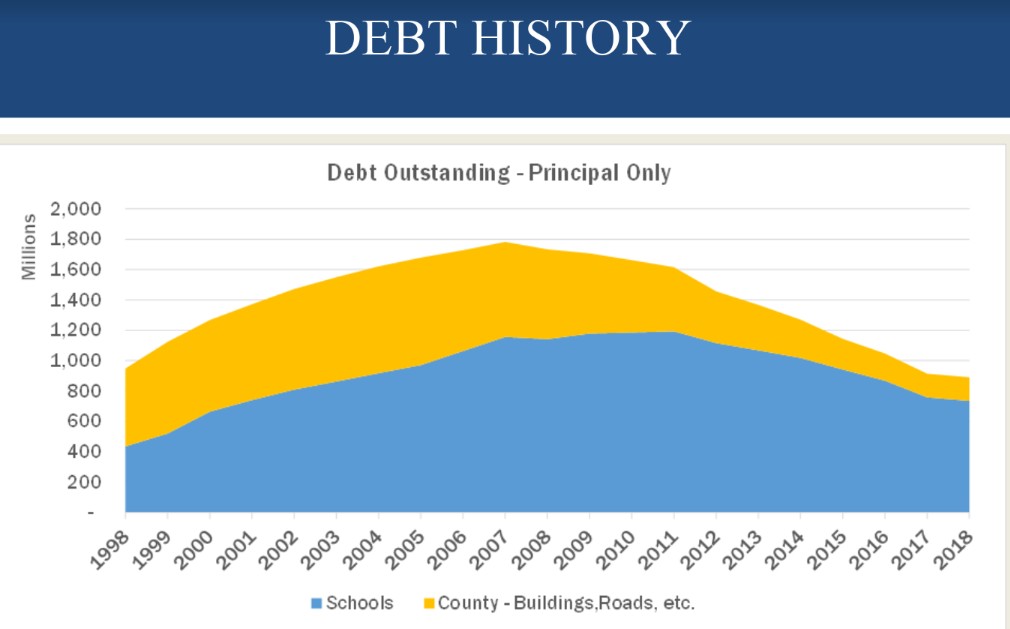

Another important piece of the financial puzzle is the county’s debt.

County Debt

If property taxes are the county’s income and the fund balance is its savings account, the debt is Shelby County’s credit card.

Like a typical credit card or mortgage statement, the county’s debt has a running balance reflecting any previous spending that hasn’t been paid off.

The county has to make regular payments against that balance. And to keep that balance from rising and having to make higher payments, the county’s annual borrowing has to remain below a certain amount each year.

If the county runs up too much debt, its credit rating suffers, making it more expensive for the county to borrow in the future. And more tax dollars have to go to debt payments, leaving less revenue to pay for ongoing services.

This chart shows the rise and fall of the county’s debt balance over time.

Like a family’s home mortgage, debt is taken out by the county for projects that would be very difficult to pay for using revenue from a single year.

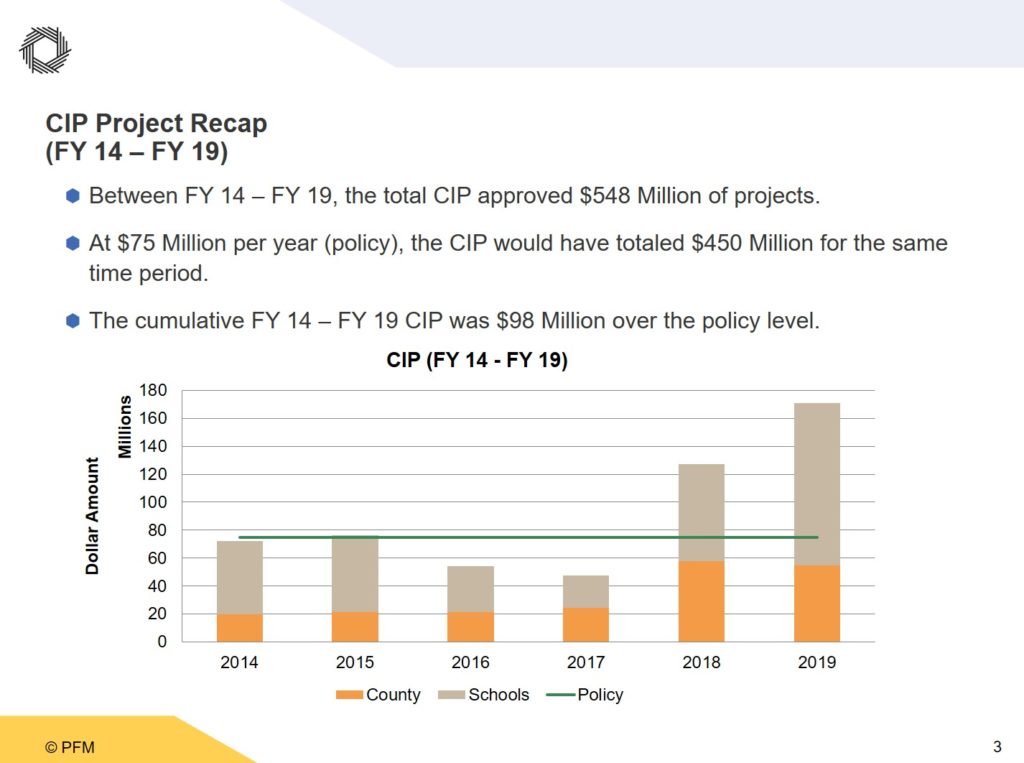

The county’s CIP budget directs how much will be borrowed and which projects will be funded.

Shelby County’s annual CIP spending policy is $75 million, meaning that’s how much we can borrow each year without the total debt increasing.

This last chart shows how well the county has minded the debt policy.

Each time the policy limit is broken, the county’s overall debt increases. That means we could quickly undo the progress of the last decade.

But there are tremendous pressures on CIP spending, chief among them the $500 million in deferred maintenance at Shelby County Schools.

Without a strategic plan for the SCS footprint in place, it could take the county seven years just to meet those existing needs without breaching the annual debt limit. And that would also mean zero dollars for any other county project for the better part of a decade.

Solving that problem is one of the biggest challenges of our time, made more difficult if we don’t take a more disciplined approach to the budget as a whole.

The Right Approach

The problems we have as a county are profound and difficult.

Sky high taxes. Declining revenues. Deficit spending. Depleted savings. Increasing debt. Aging infrastructure. Economic uncertainty. High crime. Educational gaps. Great need.

These challenges are no surprise, nor are they unique to this community. With the right approach, a little luck and plenty of prayer, there is nothing we can’t overcome.

The people of Memphis and Shelby County are resilient, bold, faithful, compassionate, energetic and innovative. We just need to focus, set some priorities and discipline ourselves.

These are my suggestions:

1 – Spend less than we take in and return to the 25% fund balance policy.

2 – Hold the line on tax rates and allow revenues to gradually rise as property values increase and economic activity improves.

3 – Prioritize core services, streamline operations and eliminate spending on all outside projects.

4 – Freeze new hiring other than those areas with a critical staffing shortage.

5 – Keep borrowing below the $75 million annual debt policy.

6 – Strategically invest in areas that make Shelby County a more attractive place to live: safety, health and education.

7 – Adopt policies that welcome business, encourage economic activity and provide opportunities for the growth and advancement of all people.

8 – Insist on a footprint plan from SCS, so that capital spending can be optimized and not wasted on underutilized, older buildings.

In addition to those more direct policies, we should:

9 – Encourage and facilitate innovation, charity, volunteerism, mentoring, maturity, healthy living, and anything that contributes to the comparative advantages and revitalized spirit of Memphis.

And one more thing:

10 – Love one another. Be joyful in hope, patient in affliction, faithful in prayer.