In this issue

- Budget approved

- Unfinished business

- Memphis First

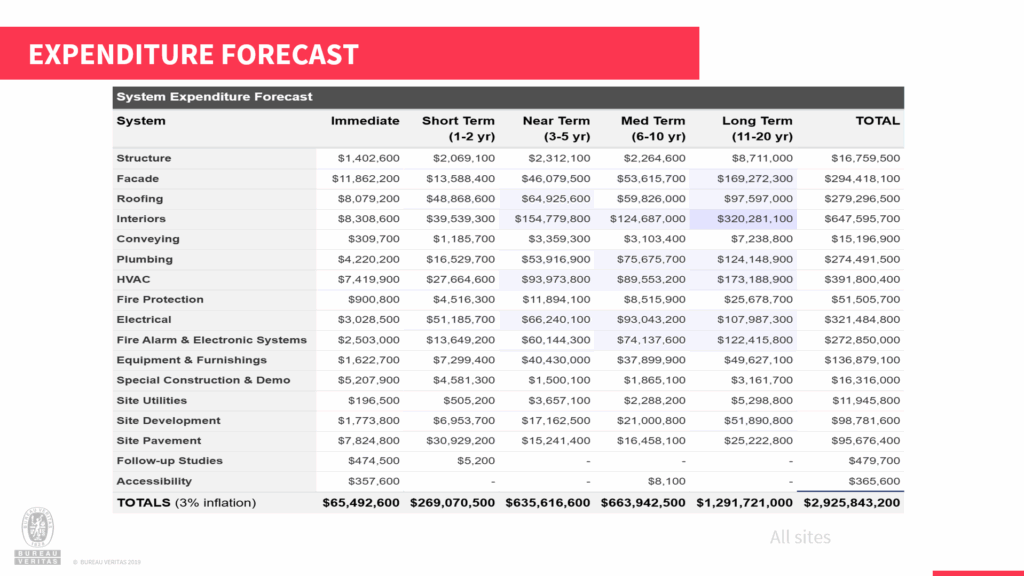

Below is the MSCS maintenance expenditure forecast from an executive summary of the district’s facility condition assessment.

Keep in mind these figures are specific to MSCS and the expense to the county will require a ADA match to the other municipal districts, which adds a ~25% multiple to the totals.