In this issue

- Bartlett’s mobile stage

- FY26 budget proposed

- MSCS facility assessment

Shelby County Government has completed its annual duty to approve a budget and set the property tax rate prior to the July 1 beginning of the fiscal year.

In previous updates, I have written about the major issues at stake and the potential options available to us. Here’s what happened.

This week Shelby County Mayor Lee Harris presented his FY24 budget proposal, which features infrastructure spending plans for Regional One and school buildings.

But the story did not begin this week. Some context is needed.

The Shelby County Board of Commissioners is set to approve a budget and a property tax rate on Monday.

What follows is some perspective on these decisions. You can view the FY23 budget as proposed by Mayor Lee Harris here.

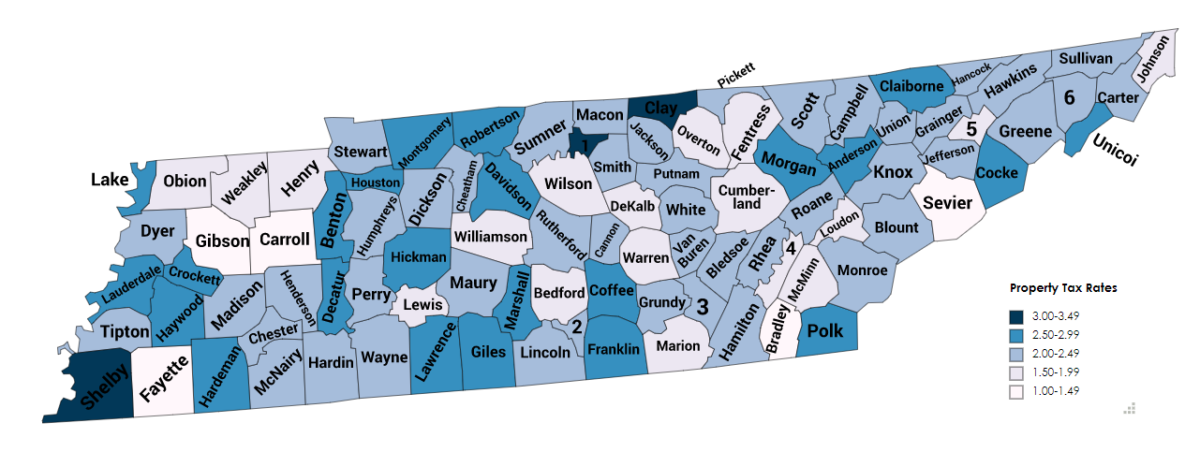

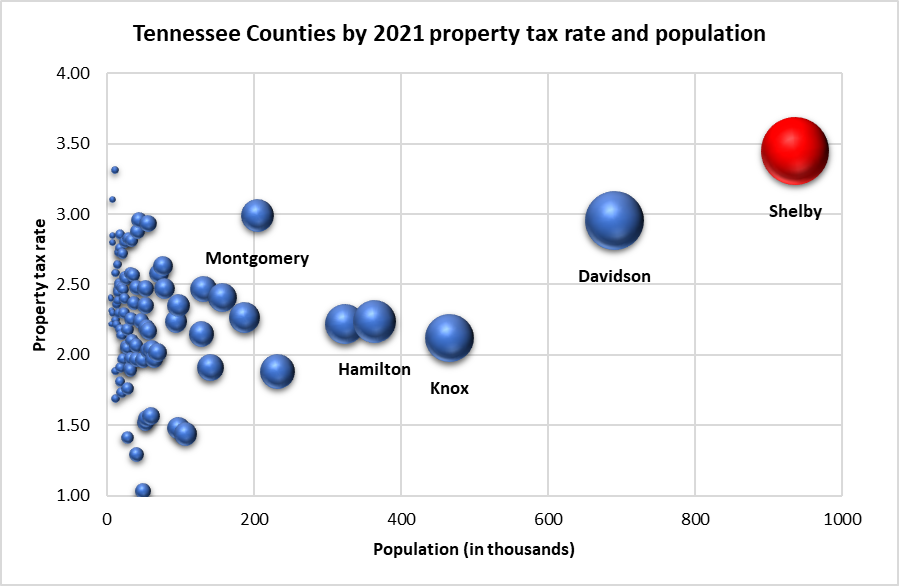

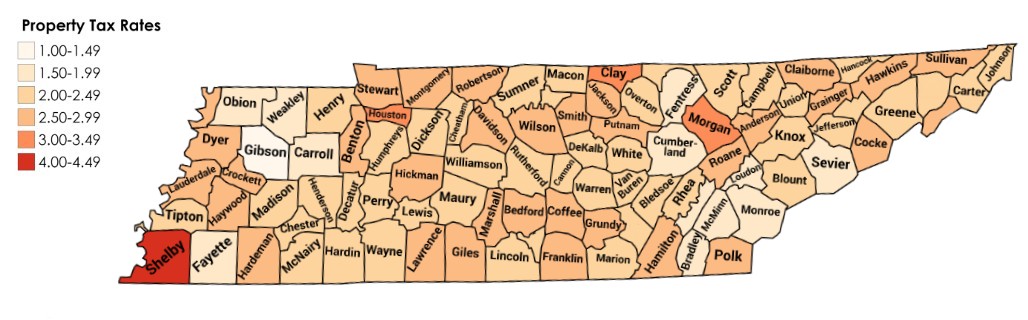

Property taxes provide about 60% of the county’s operating revenues. As seen in the map above, Shelby County continues to exact a high property tax rate in comparison to the other 94 counties.

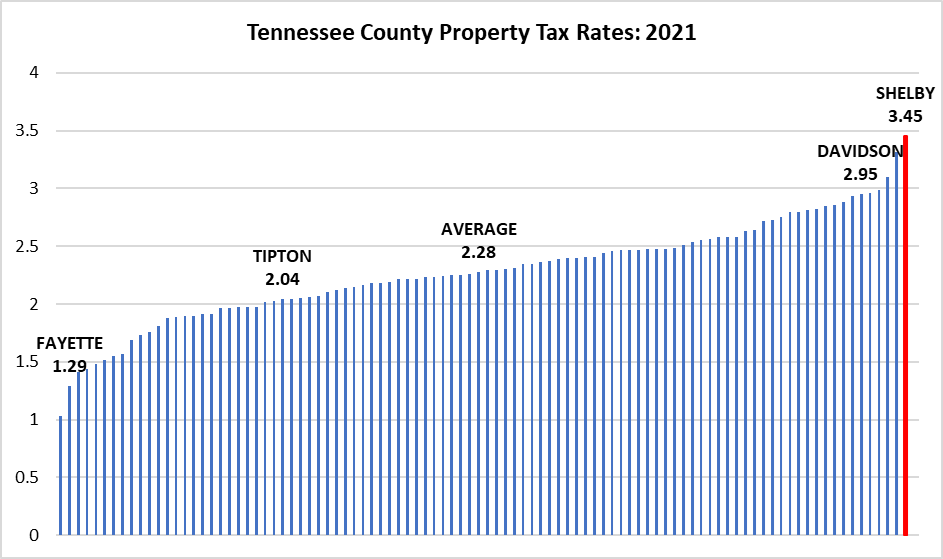

At $3.45, we have the highest property tax rate in the state. If we place every county side by side, here’s how we stack up.

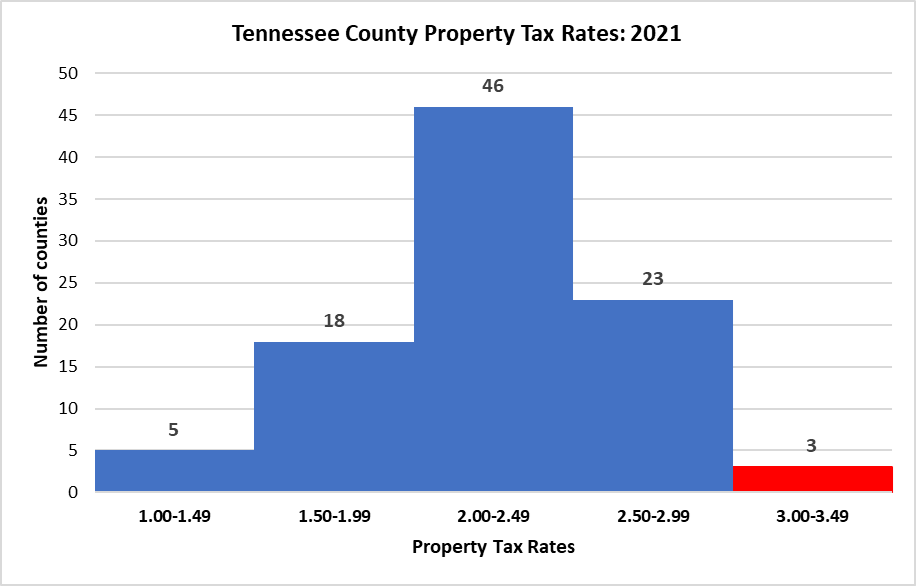

If we simplify these rates into groups, we get a more clear picture of what’s typical across the state.

Shelby is the largest county in Tennessee. Here’s what the state looks like when we view both property tax rates and population.

For fiscal year 2023, the State of Tennessee has given Shelby County a lower recapture rate of $3.399, which is the rate at which our property revenues are projected to stay even with the previous year.

Mayor Harris included the $3.399 rate in his budget proposal, but Trustee Regina Newman has informed us that her office can only include two digits beyond the decimal in the tax bill system. (The old billing software is being upgraded but the new system won’t be online for another year).

The Commission was asked to round up to $3.40 or down to $3.39. Any rate with just two digits. For now, the rate has been amended down to $3.39. If that holds, your next county tax bill will be smaller.

However, a number of commissioners would like to raise the property tax rate. Some of them agree with activists who have argued the county should keep the current $3.45 rate in place.

Each penny on the tax rate currently generates $2,361,077 in revenue. Raising the rate to $3.45 would bring in an additional $14 million. If the average home in Shelby County is valued at $235,000, this would cost the average taxpayer an additional $35.

You can calculate what these rates and others mean for you using the Trustee’s interactive tax calculator.

There are several reasons the more conservative members of the board do not want to raise taxes. The first reason is we already have Tennessee’s highest rate. The second is homeowners are being crushed by inflation and the continued fallout resulting from pandemic policies.

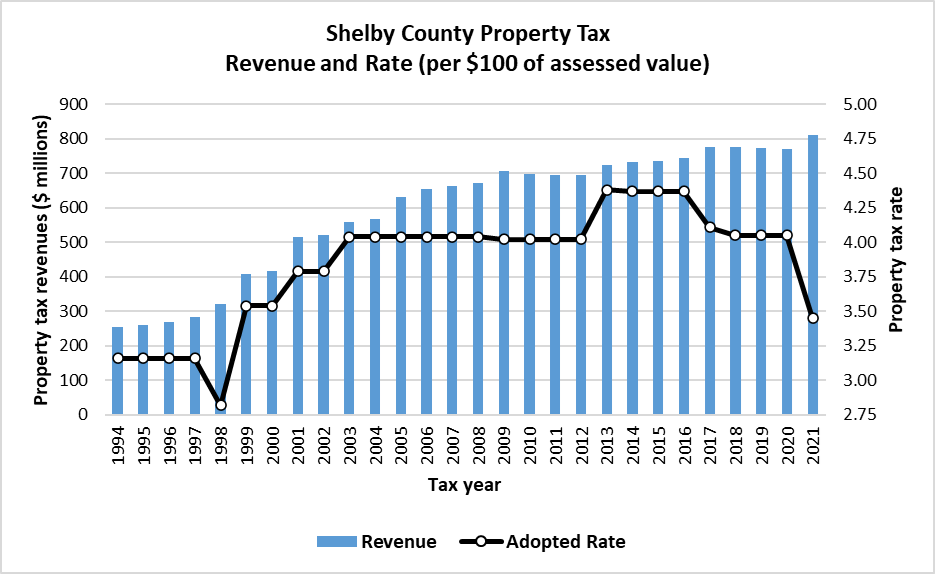

A third reason is county property tax revenues have continued to increase over the years, even when the rate has been reduced.

This trend continues as property values rise, allowing lower rates to pull in more revenue.

However, just because the value of a family’s property has increased does not mean they have any greater capacity to pay higher property tax bills.

Shelby County should continue to chip away at the property tax rate, with an initial goal of dropping from first place. An additional 9 cents off could do it. With enough spending discipline, we could get there.

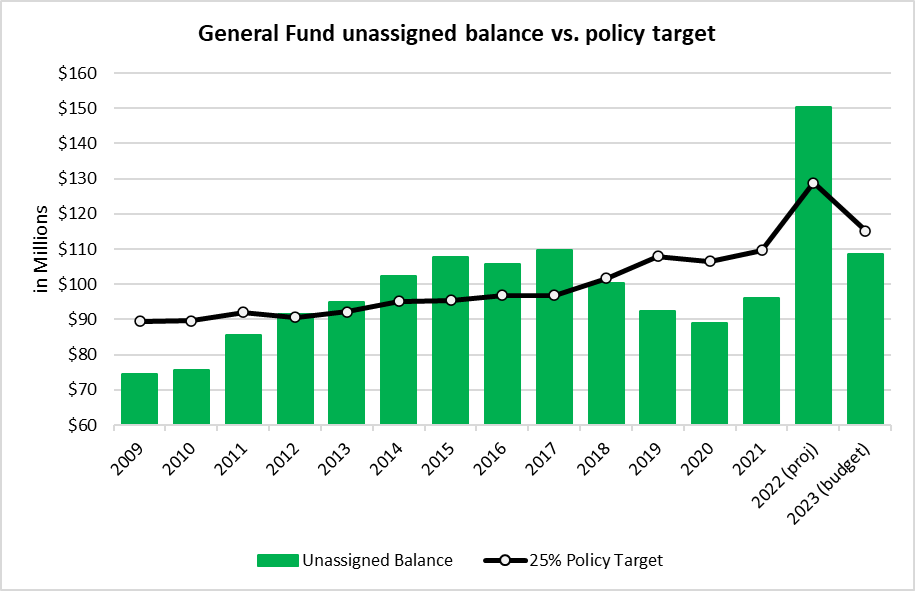

Unfortunately, spending restraint has not been our strong suit. Shelby County continues to draw from its piggy bank in order to fund regular operations.

In recent years, this has kept the county from hitting its policy target of keeping 25% of revenues as an unassigned balance in the general fund at the end of each fiscal year. We only surpassed the fund balance goal once this term, due to a massive influx of federal spending.

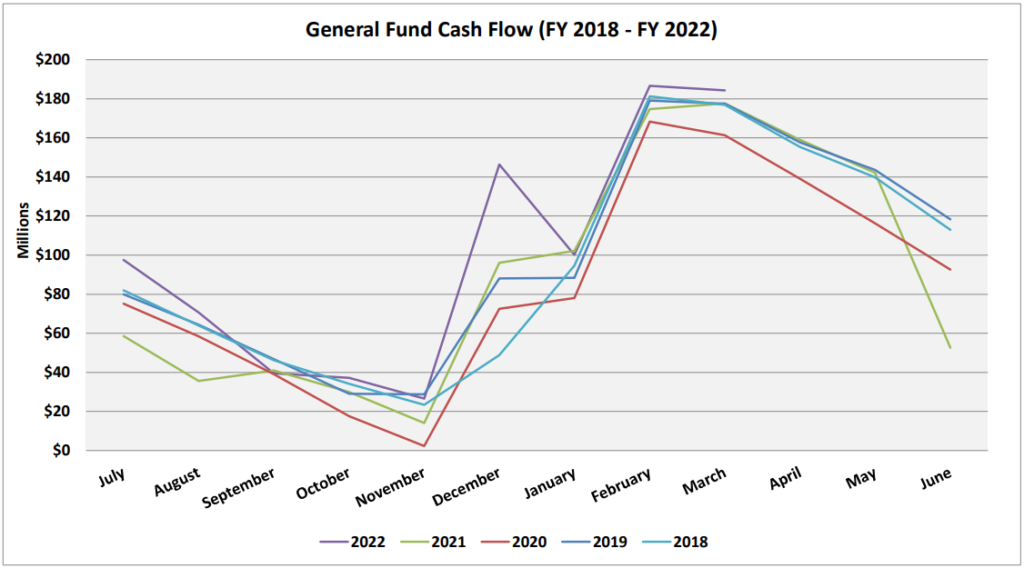

The unassigned fund balance is important because the county draws from this account throughout the year, and that account gets very thin in the final months before taxes are due.

Without a healthy balance, we have a cash flow problem in November, and that could make it difficult for the county to pay its bills.

The last thing we would want to do is run out of money and end up having to borrow cash just to meet payroll. We have enough debt to worry about.

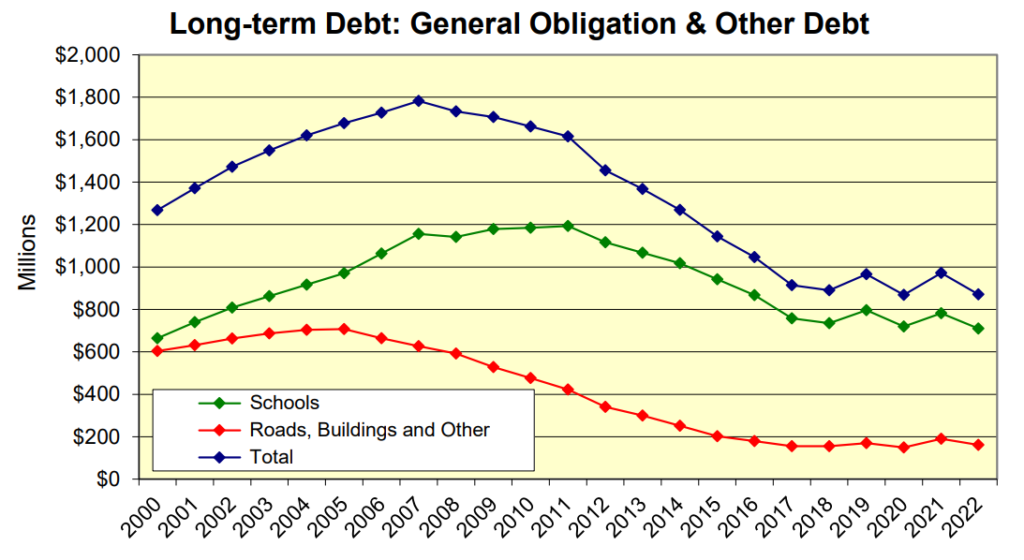

Between 2008 and 2018, Shelby County did a good job paying down its long term debt. In that 10 year period, the county debt dropped by almost $1 billion. For the last four years, the balance has held steady.

The long term debt is driven by our capital improvement project (CIP) budgets. These budgets cover large projects financed over multiple years such as building construction, renovation, and maintenance; infrastructure; and information technology systems.

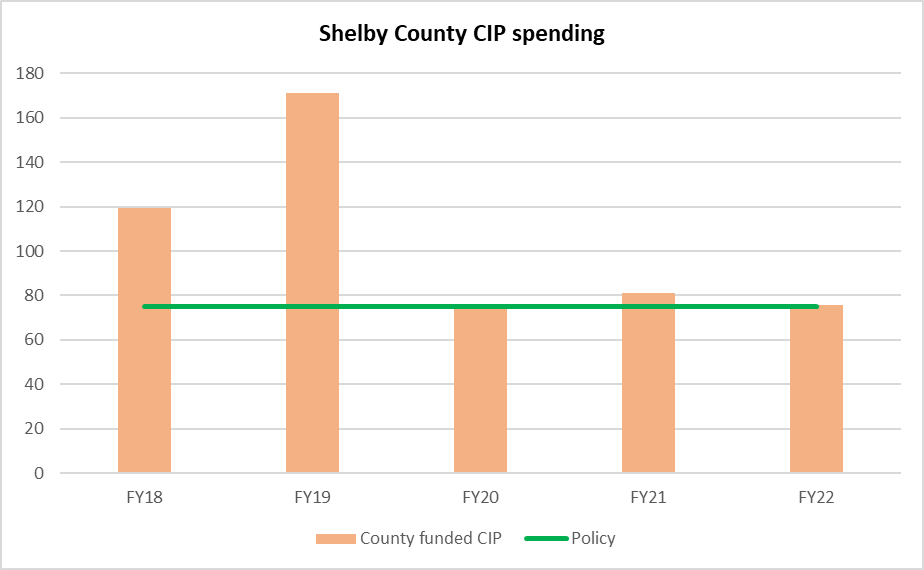

The county’s CIP spending policy is to limit these projects to $75 million a year unless it has a very good reason to do otherwise. Staying within the policy limit helps the county maintain its solid credit rating, which lowers the cost of government.

The county has done a fair job adhering to the policy. In FY18 and FY19, the cap was exceeded by far. However, the county was reversing course after a couple of leaner years in which there had been no allocations for the schools.

The last three CIP budgets have come in right around $75 million, and the mayor’s proposal for FY23 is about $3 million above the target.

The problem is the county’s anticipated needs are far greater than the CIP policy can cover. That’s putting pressure on the mayor’s office and the board of commissioners to increase spending and add millions back to our long-term debt.

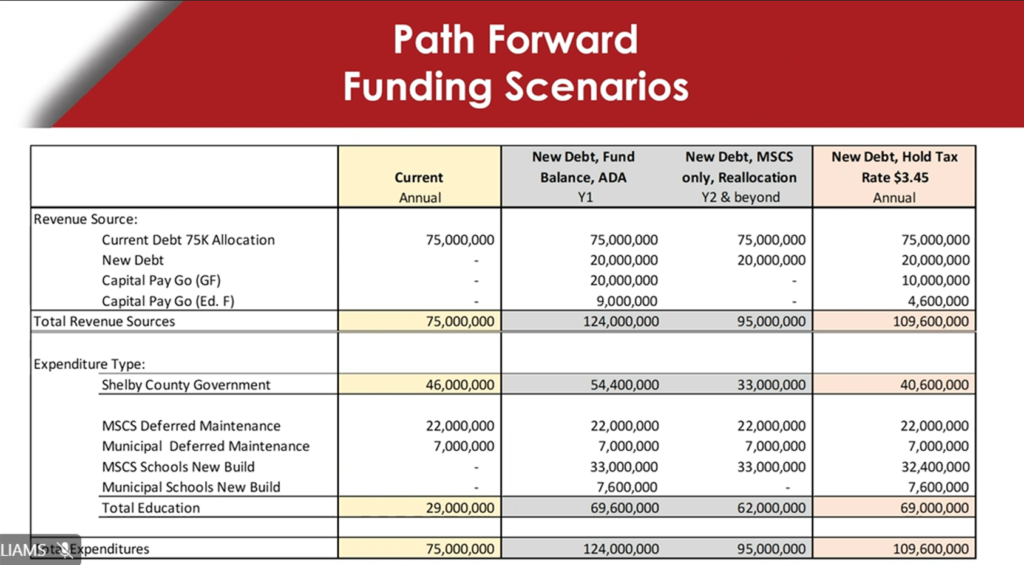

The county’s Finance Department recently presented a few scenarios showing what might happen under different CIP spending policies.

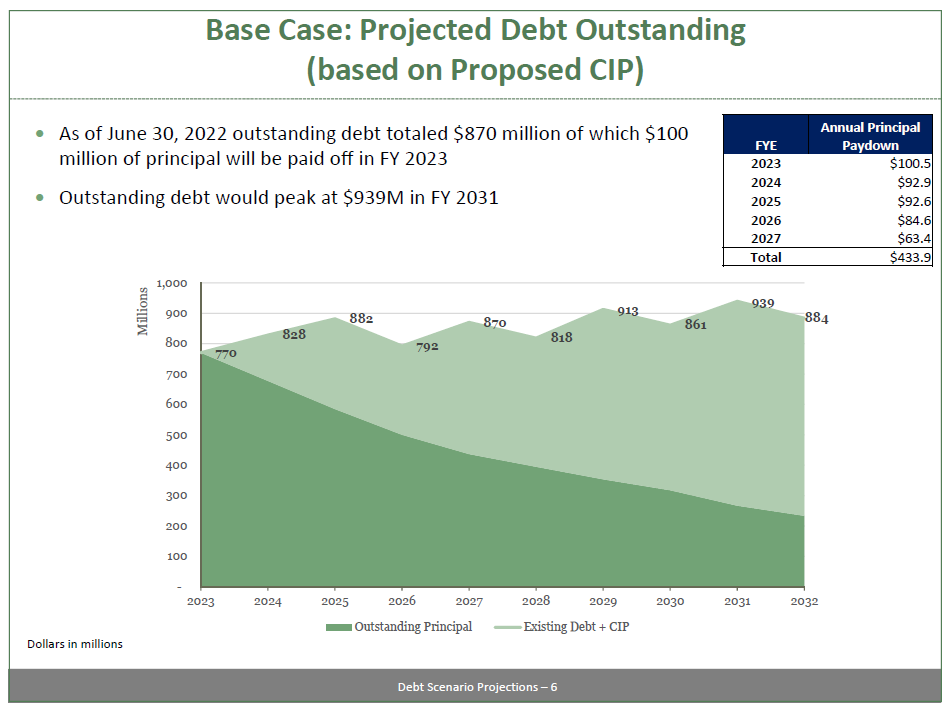

First was a “base case,” in which CIP spending is held constant. It shows the overall debt level slowly drifting upward, presumably as higher interest rates drive up the cost of future borrowing.

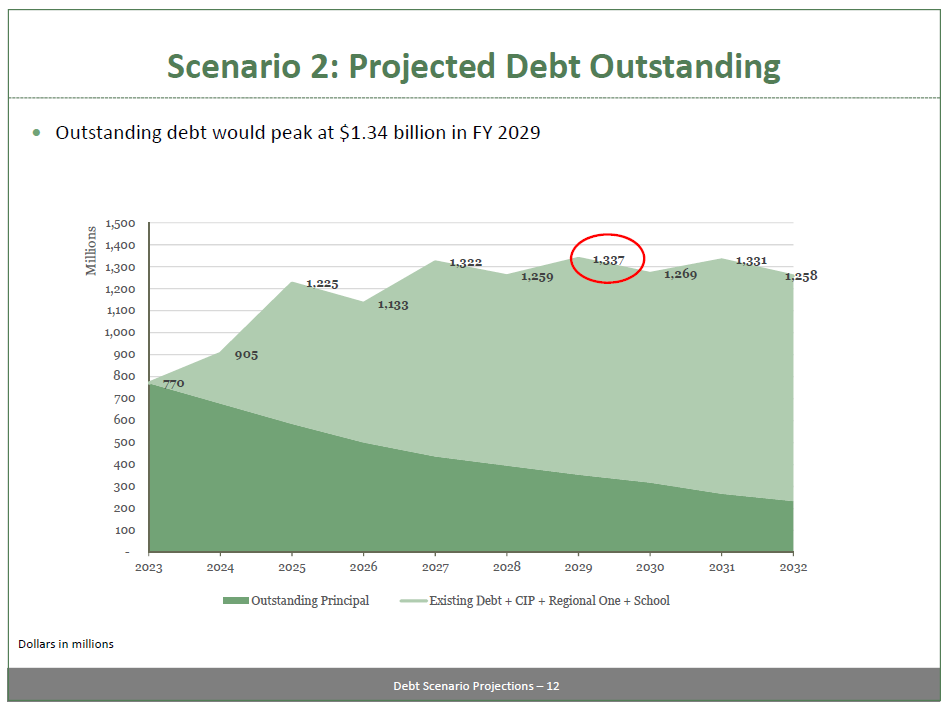

Other scenarios projected debt levels if Shelby County spent $350 million on renovations at Regional One over the next five years, pledged $55 million a year to school construction projects on top of its other anticipated needs, or did both (as illustrated in Scenario 2, below).

Unfortunately, none of the scenarios cover the full requests.

Memphis Shelby County Schools is asking the county for $550 million for new construction and deferred maintenance, in addition to the approximately $20-30 million already included in recent CIP budgets.

As seen in the MSCS “Path Forward Funding Scenarios” slide, they suggest the county increase CIP spending to $124 million annually for ten years in order to meet their request and cover the split for the municipal systems.

But that figure does not include anything for Regional One. Add another $35 million annually for 10 years, and we’ve more than doubled the CIP budget, which would hit $159 million.

Finding a way to meet these needs is the most important financial challenge facing county government, and in four years we’ve made zero progress toward that end.

For these reasons, I’m less receptive to the new plan that would dedicate up to $15 million (and beyond) annually to MATA from the scheduled expiration of PILOT incentives.

I appreciate the creativity, but the plan does not meet several of the conditions I laid out in 2020 (see graphic below), especially the second one: putting education and public safety first.

The county should not grant other requests before meeting its own responsibilities to education and to our trauma center.

And that’s without mentioning $20-30 million in additional, regular operations requests from across county government that were not included in the FY23 budget proposal but are sought by division leaders.

I don’t doubt the need for transit funding in Memphis. I don’t denounce the vision. I simply believe the county should meet its own responsibilities first.

The path to prosperity in Shelby County is not easy, but it’s simple.

Like any regular individual, family, or business, we need to restrain our spending, prioritize our needs, and live within our means.

The Shelby County Commission meets Wednesday to take another stab at approving a balanced budget.

The economic downturn makes that task more difficult.

We’re rolling into Fiscal Year 2021 with little room for error. The county will collect less than originally expected this year and has lowered its projections for the next.

Some are calling for us to make up the revenue shortfall by increasing property tax rates. Here are a few reasons why that can’t happen.